The New York State Consumre Protection Board (CPB) helps promote and sustain the economic security and self sufficiency of all New Yorkers through the development and implementation of various initiatives and programs. The Agency partners with governmental agencies, community-based organizations and other stakeholders to assist consumers in building skill sets and producing and maintaining economic assets for a stronger New York.

Personal Finance

Personal finance involves a wide range of subjects. Understanding the fundamentals will enable you to meet the financial challenges of today and prepare you for the financial challenges of tomorrow.

Consumer Protections: New NYS Refund Law

The CPB alerted consumers and merchants about the new retail refund law that took effect on December 1, 2009 through media and educational efforts. The amendment was initially proposed by the CPB and was signed by Governor Paterson in August 2009. Under the law, merchants are required to affirmatively post refund policies, subject to any fees, including a restocking fee, and the dollar or percentage amount of each fee. The new law removed the exemption which provided that merchants who do not post a refund policy are assumed to provide cash refunds for 20 days from the date of purchase, and thus were absolved from any posting requirement. Customers are now authorized to return any item for a full refund for up to 30 days from the date of purchase should the retailer fail to post a refund policy, as long as the buyer can verify the date of purchase with a receipt or other proof of purchase. Retailers must make a written copy of the store's refund policies available upon request and note this availability on its refund policy signage. Refund policy signage must also provide consumers with advance notice if return of any purchase is subject to fees, and if so, the exact dollar or percentage amount of such fees. This includes disclosing restocking fees, which the law defines as "any amount charged by a seller for accepting returned merchandise and issuing a refund or credit."

Stretch Your Dollars Effort (SYDE)

The CPB's acclaimed SYDE program helps consumers make ends meet in the current economy. This innovative project, part of Governor Paterson's economic well-being initiative, provides a forum for New Yorkers to share their dollar-stretching tips with others by e-mailing or sending a written, audio or video tip to the CPB, using a designated e-mail address. Money-saving and cost-cutting strategies submitted by the public are then posted on the CPB's website, covering topics such as grocery shopping, back-to-school shopping, buying gasoline, and preparing food at home. This exchange of ideas is helping consumers cope with these times of fiscal constraint and economic hardship.

To help raise awareness of this program and the need to be cost conscious, the CPB partnered with the New York State Office of Temporary and Disability Assistance to include notice about SYDE in a letter that was sent to 434,000 New Yorkers receiving a one-time federal stimulus check for back-to-school expenses. By utilizing tips found on SYDE, these recipients could make their stimulus money go farther in the marketplace.

Financial Life Skills

The CPB created resources and programs to help build practical money skills and advance financial responsibility and stability. These creative resources have been made available through different forums and mechanisms.

Banking on Our Children Program

To promote a greater understanding of the value of money among youngsters during difficult economic times, the CPB launched a series of innovative "Banking on Our Children" educational videos and activity sheets in 2009. The videos, which were produced by the New York Network of the State University of New York, teach the importance of saving and spending wisely and provide young children with a solid foundation for a viable financial future.

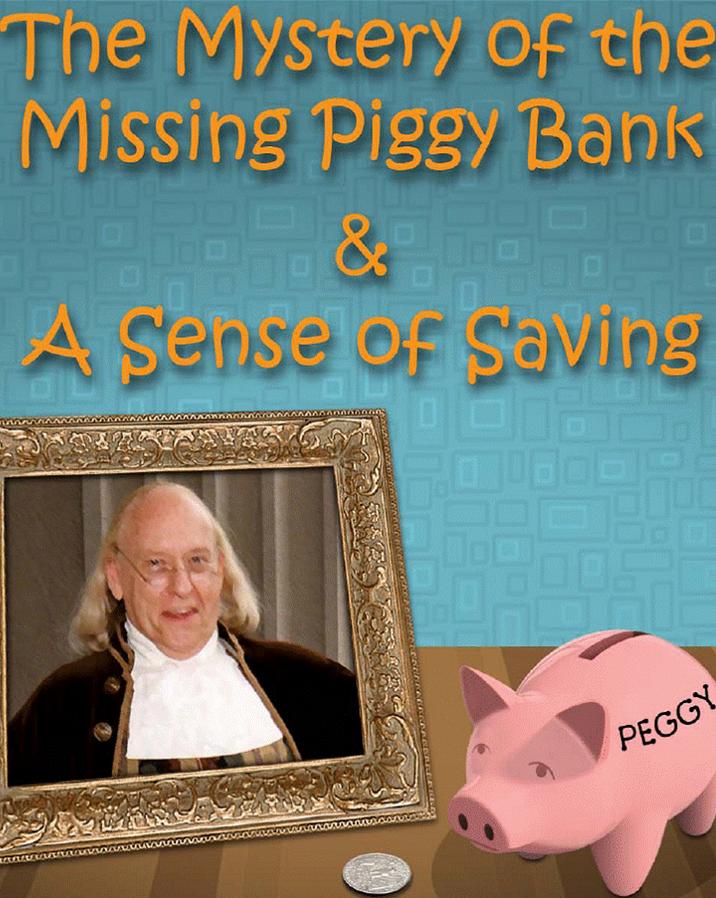

Video is a highly effective medium for delivering lessons to children. In "The Mystery of the Missing Piggy Bank," which is geared to children aged 4 - 6, the heroine learns the value of saving money when she loses her bank and follows clues to find it. In "A Sense of Saving," children aged 7 - 9 receive an important lesson on spending beyond their means from Ben Franklin, who informs them that "a penny saved is a penny earned!"

To gain wide distribution of the videos, the CPB partnered with organizations including the Independent Bankers Association of New York State, the Boys and Girls Clubs of America, the YMCA of New York State, the New York Charter Schools Association, the Public Schools Library System and the New York State Public Libraries. The YMCA of New York State incorporated the Banking on Our Children videos into its programming by establishing a link to the CPB's homepage on its website and sending information about the videos to all of its branches. First Niagara Bank (FNB) adopted the Banking on Our Children video project as part of its school banking program. FNB made 200 copies of the videos and distributed them to the schools in its program across the State. In addition, CPB Chairperson and Executive Director Mindy Bockstein was the keynote speaker at the FNB School Banking Volunteer Appreciation Luncheon in May 2009.

The CPB also promotes the videos through its website, E-blasts, newsletters, and the media. Indeed, the videos aired on Ion Television and are featured on the Albany Times Union website. As a result, thousands of elementary school students across the State are learning about financial matters.

In July 2009, the CPB and New York Network received a Gold Classic "Telly" Award for "A Sense of Saving." Founded in 1978, the Telly is the premier award honoring outstanding local, regional and cable television commercials and programs, as well as video and film productions.

In October 2009, the CPB worked with the New York State School for the Blind to produce a "described" version of the Banking on Our Children videos. A sound overlay provides concise descriptions of each video's visual elements. As a result, blind and visually impaired children now have the opportunity to enjoy and benefit from the first described financial education videos for children available from a New York State agency. The described videos are being distributed through partners including the National Federation of the Blind of New York State and Parents of Blind Children of New York State.

The videos have been a highly effective means of teaching basic financial skills to thousands of elementary school students across New York - - including those with visual impairments. Without this new educational tool, many of these students would have little or no exposure to lessons about money.

Colleges and Circle K International

The CPB continued its College Financial Literacy Tour this year by conducting a series of workshops around the State. The Agency made stops at several schools and universities, including SUNY Downstate Medical Center, SUNY New Paltz, SUNY Morrisville State College, CUNY Lehman College, Mercy and Nyack Colleges, Skidmore College, SUNY Onondaga Community College, Mildred Elley and the Austin School of Spa Technology.

The CPB conducted workshops at the Kiwanis Circle K District Convention in Lake George. Circle K International is a collegiate service organization that promotes service, leadership, and friendship. Student representatives from Adelphi University, City College of New York, Clarkson University, C.W. Post, Hudson Valley Community College, Nassau Community College, New York University, Rochester Polytechnic Institute, Sage College, and SUNY schools at Albany, Elmira, Geneseo, New Paltz and Potsdam learned about financial life skills, such as credit card usage and credit vs. debt. The representatives were then able to impart this information and knowledge to their peers.

Community Engagement

Given the fiscal crisis in 2009, the CPB partnered with diverse groups to offer financial education and tools to assist hard hit New Yorkers. For example, the Agency's resources were made available on the website of the Office of Temporary and Disability Assistance. Career Gear clients and the staff of the Coalition for the Homeless gained access to the CPB's financial literacy publications. The CPB collaborated with the New York State Division of Probation and Correctional Alternatives to incorporate its financial life skills educational materials into the Division's Ready, Set, Work program. The migrant farming community was provided financial literacy support through a partnership with the New York State Agri-Business Child Development Centers. High school students in New York City and the Capital District were treated to financial literacy workshops from CPB experts.

The CPB was an integral partner in the development of the Help Wanted! series produced by WMHT, the public broadcasting station in the Capital District. Through this series, the CPB advanced its expertise and financial education resources to educate and help the public deal with the uncertain economic times.

Credit Card Campaign for Change

For decades, credit card issuers subjected consumers to many unfair and deceptive practices. To address this concern and spur reform in the credit card industry, the CPB launched its multi-prong Campaign for Change. Consumers were invited to complete a credit card survey relating their experiences and concerns about such unfair practices as double cycle billing, retroactive interest rate hikes, and due dates that change from month-to-month. The campaign included articles in media outlets and a letter-writing effort to federal regulators and legislators urging reform. In conjunction with this public input, the CPB worked with the New York Congressional Delegation to advance credit card changes.

The advocacy paid off in May 2009 when the federal Credit Card Accountability, Responsibility and Disclosure (CARD) Act became law. The reforms contained in the CARD Act mark the beginning of a new era for consumers. There are now prohibitions on assessing fees for making payments online or over the phone, and restrictions on over-the limit and late penalty fees. Payments must be due on the same day each month, and if the due date falls on a weekend or holiday, no late penalty can be assessed if payment is received on the next business day. No longer will consumers be subjected to practices such as double-cycle billing, universal default, and retroactive interest rate hikes. Credit card bills must now disclose how long it will take to pay off the existing balance, and the total cost in interest charges, if a consumer pays only the minimum amount due each month.

The CARD Act also provides important new safeguards for young consumers, who for years have been bombarded with credit card solicitations. Over the recent years, the CPB has worked with SUNY and other instiutions of higher learning to imprss upon students the need for credit restraint. Indeed, according to a 2009 study by Sallie Mae, 84% of undergraduates have at least one credit card, half of the students have four or more cards, and seniors graduate with an average credit card debt of $4,100. The study found that many college students use credit cards to "live beyond their means - - not just for convenience," and more than three-quarters of students incur finance charges by carrying a monthly balance.

Under the CARD Act, credit cards cannot be issued to consumers under age 21 unless the applicant obtains a co-signor (usually a parent, but can be anyone over the age of 21) or can show sufficient income to repay charges to the account. Credit card companies are no longer permitted to market credit cards within 1,000 feet of a college campus. "Freebies" such as free T-shirts and magazine subscriptions can no longer be used by credit card issuers to attract college students on or near campus or at university-sponsored events. Additionally, credit card companies cannot send pre-screened card offers to anyone under 21 unless the consumer opted-in to receive such offers.

The CPB's Campaign for Change did not end with the enactment of the CARD Act. The CPB made available on its website a Credit Card Reform Survey to evaluate how the credit card industry responded to the enactment of this law and whether card issuers were implementing changes, such as higher interest rates and lower credit limits, in advance of the CARD Act's effective date. On August 19, 2009, one day before the effective date of the first round of CARD Act protections, the CPB issued a press release announcing the initial survey results. More than 90% of respondents stated that their card issuer changed the terms of their agreements. Nearly all respondents stated that the change involved an increase in their interest rate, and 62% said their interest rate was hiked despite the fact that their balance had been completely paid off at the end of each billing period.

In conjunction with the CARD Act reforms, the CPB filed comments with the Federal Reserve Board (FRB) on proposed amendments to Regulation Z (Truth in Lending) calling for greater disclosure of the term "0% interest" and other advertising terms such as "no interest," "no payments," or similar verbiage. The CPB also urged the FRB to require special deferred interest plan disclosure language on each document that includes a reference.

During this past year, the CPB created a wide variety of bi-lingual resources to help consumers choose and use a credit card wisely. These include tip sheets, brochures and web alerts. As a result, consumers are learning what credit is; how to shop around for the best credit card terms; how to execute good credit card management skills; how to avoid harmful credit card industry practices; what credit reports are; and, how to deal with credit reporting agencies.

Debt Collection

Debt collection horror stories of harassing phone calls, threats of violence or harm, impersonation of government officials, and other abusive, high-pressure tactics continue to mount. In fact, the CPB received nearly 4,000 complaints and/or inquiries about debt collection practices over the past four years. In 2009, the CPB raised awareness about the need for debt collection reforms through its legislative and educational efforts.

Federal and State debt collection laws are out of step with the times, do not account for new technologies, fail to address new tactics being used by debt collectors, and were written before debt was commonly sold as a commodity between third-party collection agencies or debt buyers.

Consequently, Governor Paterson and the CPB proposed legislation to update and strengthen legal protections for all New Yorkers. Consumers should not have to go through round after round of fighting with debt collectors as their purported "debt" is repeatedly sold and assigned to one debt collector after another. Consumers should not be subjected to threatening or abusive conduct by debt collectors. Governor Paterson's proposed law increases the penalties for violators; affords consumers the right to sue and receive attorney fees, court costs and actual damages for successful actions against debt collectors and creditors; compels collectors to contact debtors between the hours of 8 a.m. and 9 p.m. only; requires that notice be provided to consumers if a debt is transferred or sold; prohibits threatening or abusive conduct by debt collectors; and, increases the State award limit for statutory damages to $2,500 from the current $1,000. To help generate public support for the legislation, CPB Chairperson and Executive Director Mindy Bockstein wrote op-ed pieces that were published in the Journal News and the Albany Times-Union.

In addition to its advocacy work to change policy, the CPB created an online Debt Collection Information Center which provides invaluable resources for consumers. Included are tips on how to spot and fight illegal debt collection practices, a summary of consumer rights under federal and State law, and advice on how to validate a debt. There are also sample letters that consumers can use to dispute a debt and to stop debt collection calls (cease and desist letters).

Proprietary Schools

By providing quality training to enrolled students, licensed private career schools, known as proprietary schools, contribute to our State's economic security. The CPB serves on the New York State Education Department's (SED) Proprietary School Advisory Council to represent and advocate for the interests of consumers.

In collaboration with the SED's Bureau of Proprietary Schools and the Proprietary School Advisory Council, the CPB promoted resources and information this year for use by high schools, service organizations, and others to educate potential students about the protections offered by licensed schools and the pitfalls of choosing an unlicensed school. These materials are currently available in English, Spanish, French, Chinese, Korean, and Russian. In addition to the CPB's distribution, these resources are also available through the New York State Department of Labor's CareerZone and JobZone websites. The CPB created and made presentations on this topic to help prevent students from being taken advantage of by disreputable, fly-by-night unlicensed schools.

Further, in order to generate additional attention, the issue of unlicensed proprietary schools was the subject of one of the CPB's monthly Spanish columns published in the major Spanish-language newspapers and was highlighted in WMHT-TV Help Wanted! series.

The CPB also worked with proprietary school students on other topics, such as financial literacy. As noted previously, the Agency provided a highly successful train-the-trainer financial literacy workshop for teachers and students at Mildred Elley and Austin School of Spa Technology this past year.

Home Finances

Owning a home is part of the American Dream and likely the largest purchase and investment a consumer will ever make. Recognizing that home ownership is not only a dream but also an important responsibility, the CPB offers a series of resources, presentations and programs to help consumers purchase a home and preserve its value and equity.

The CPB, in conjunction with the New York State Builders Association (NYSBA), continued its successful "Ask the Expert" program which provides consumers with reliable project assistance and information to help assure they spend their money wisely.

During the Spring and Summer, consumers have the opportunity to submit home improvement questions via a dedicated e-mail address. Responses are posted on the CPB's "Ask the Expert" web page, covering such topics as remodeling, refinishing, electric, floor coverings, painting, plumbing, heating, and cooling, among others.

Additionally, this year, the CPB expanded on its web-based "Ask the Expert" program by creating its first home improvement protection and advice call-in event. Together with the Capital Region's public broadcasting station, WMHT, which hosted the event, the CPB partnered with the NYSBA, the New York State Energy Research and Development Authority (NYSERDA), the New York State Division of Housing and Community Renewal (DHCR) and the Preservation League of New York State to have experts respond to telephone calls from consumers on topics, including kitchen and bath remodeling, plumbing, heating, A/C, sheet metal installation and servicing, construction management, site development, window/door installation, home-building, energy-efficiency, home improvement funding for low-income consumers, improvements on historical buildings, and more. The event was publicized through traditional and online media and pro-bono public service announcements on television and radio. Consumers from 28 counties in the State accessed information and assistance from our event. Additionally, CPB Consumer Advisors were on hand to provide mediation assistance to people who were having a problem with a home improvement contractor.

Home Purchasing and Foreclosure Prevention

Economic hardships and unemployment have contributed to a large number of mortgage defaults and foreclosures. Public policy and educational efforts on the part of the CPB and others are aimed at assisting distressed homeowners in keeping their homes.

The CPB continues to be an active participant on Governor Paterson's Halt Abusive Lending Transactions (HALT) task force, a coalition of State agencies that regulate or monitor mortgage activities on the federal and State level and interact with consumers to provide foreclosure assistance. This year, the CPB focused its efforts on advancing homeowner education regarding various scams, including foreclosure rescue and loan modification scams that target distressed homeowners.

In addition, the CPB commented on State and federal legislation through the HALT Task Force, which provided for greater consumer protections and disclosures in home financing.

The CPB joined with NeighborWorks America and other partners to launch the statewide "Loan Modification Scam Alert" campaign. The campaign provided homeowners facing the possibility of foreclosure with vital information to guard against loan modification scams, find trusted help, and report illegal activity to authorities. This effort was the highlighted feature of the CPB's Consumer Action Day where hundreds of New York consumers took advantage of information and direct services offered by more than thirty State, federal, and not-for-profit agencies at the Empire State Plaza. Additionally, co-branded posters and flyers were distributed at outreach events and displayed in various locations where large numbers of people congregate.